What is Hedging in the Forex market?

What is Forex Hedging?

Forex hedging is a strategy used to protect against adverse price movements in the foreign exchange market. Traders employ this technique by opening additional positions to offset potential losses. It’s often a short-term measure to mitigate risk during periods of market volatility.

There are two primary methods for hedging forex pairs:

- Taking the Opposite Position: This involves opening a position that is opposite to the existing one in the same currency pair. For instance, if you hold a long position in EUR/USD, you could hedge by going short in the same pair.

- Buying Forex Options: This involves purchasing options contracts to limit downside risk. For example, a trader holding a long EUR/USD position might buy put options to protect against a price decline.

Key Takeaways

- Forex hedging is a risk management tool to protect positions from losses.

- There are two main strategies for hedging: taking the opposite position and buying options.

- Perfect hedges eliminate all risk but also all potential profit.

- Imperfect hedges reduce risk but also limit potential profit.

1. Strategy One: Perfect Hedging

A perfect hedge involves simultaneously holding both a long and a short position in the same currency pair. This completely eliminates risk but also prevents any profit. Traders often use this strategy to protect existing positions during periods of high volatility or before significant news events.

2. Strategy Two: Imperfect Hedging

An imperfect hedge uses forex options to partially protect a position. This strategy limits downside risk but doesn’t eliminate it entirely. Traders can buy put options to protect against price declines or call options to protect against price increases.

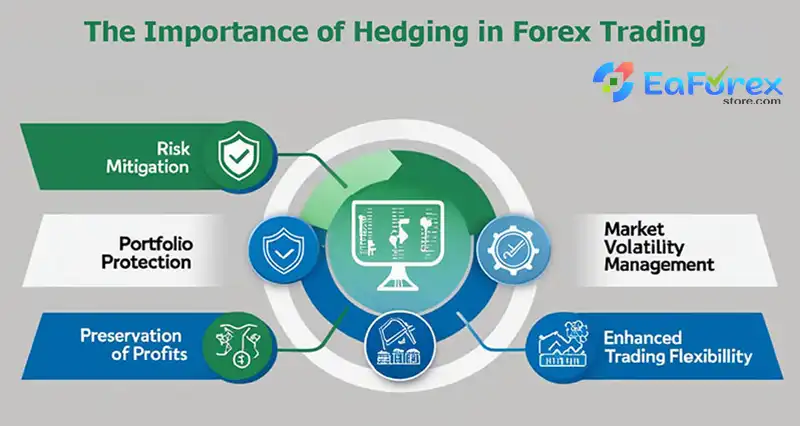

Why Hedge Forex Risk?

Hedging can help reduce losses due to market volatility. For companies, it’s important for protecting profits, cash flow, and asset values.

Is Forex Hedging Profitable?

Forex hedging itself is not directly profitable. While it can protect against losses, it also comes with costs. For speculators, it can be a tool to manage risk and potentially increase profits, but for companies, it’s primarily a risk management strategy.

Conclusion

Hedging is a valuable tool for managing risk in forex trading. By understanding the different strategies and their implications, traders can make informed decisions to protect their positions and potentially improve their overall profitability.