What is the Martingale system?

Introduction

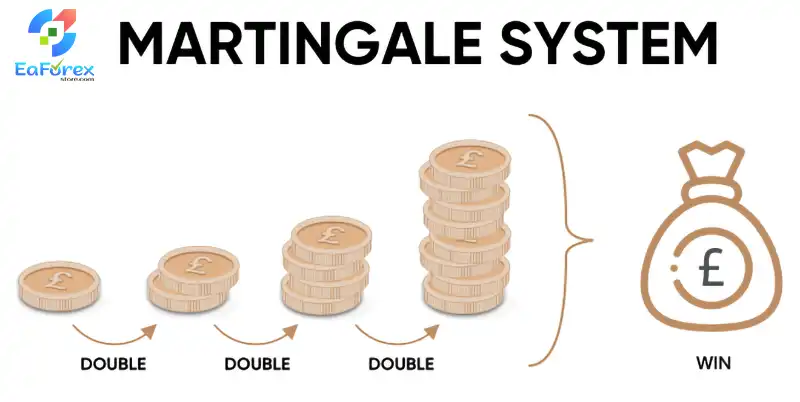

The Martingale system, a popular investment strategy, has been employed by gamblers and traders for centuries. This risk-seeking approach involves doubling your investment after each loss in the hopes of recouping losses with a winning trade. While the Martingale system offers the allure of potential high returns, it’s essential to understand its underlying principles, advantages, and significant drawbacks before considering its implementation.

Understanding the Martingale System

The Martingale system is built upon the premise of mean reversion, suggesting that market prices eventually return to their average levels. By consistently doubling your investment after losses, you aim to capitalize on this reversion. However, this strategy hinges on having a substantial amount of capital to withstand a series of consecutive losses, as the potential for bankruptcy increases with each unsuccessful trade.

How the Martingale System Works?

To illustrate the Martingale system, let’s consider a simple coin-tossing example. Suppose you bet $1 on heads. If the coin lands on tails, you lose your initial bet. According to the Martingale strategy, you would then double your bet to $2 on the next toss. If you lose again, you would bet $4, and so on. The theory is that eventually, you will win a toss and recoup all your previous losses, plus a profit.

Advantages of the Martingale System

- Potential for High Returns: When the market does revert to its mean, the Martingale system can yield substantial profits.

- Simplicity: The strategy is straightforward to understand and implement.

Drawbacks of the Martingale System

- Risk of Ruin: The Martingale system’s reliance on doubling down after losses can lead to significant financial losses if a series of unfavorable outcomes occurs.

- Limited Capital: The strategy requires a substantial amount of capital to withstand a series of consecutive losses.

- Transaction Costs: Frequent trading can incur significant transaction costs, eroding profits.

- Market Limitations: Market fluctuations and limitations on trade sizes can hinder the effectiveness of the Martingale system.

The Martingale System in Forex Markets

The Martingale system is particularly popular in the forex market due to several factors:

- Currency Stability: Currencies rarely become completely worthless, unlike stocks.

- Interest Income: Forex traders can earn interest on their positions, which can help offset losses.

- Positive Carry: Trading currency pairs with positive carry can provide additional income.

Conclusion

While the Martingale system offers the potential for significant gains, its inherent risks and limitations make it unsuitable for many investors. It’s essential to carefully consider your risk tolerance, financial goals, and understanding of the market before implementing this strategy. For those seeking a more conservative approach, alternative investment strategies may be more appropriate.