-

Unlimited Activations

You can use product with unlimited account

-

Instant delivery

Download link will be sent instantly after purchase

-

Easy to install

Pre-activated, ready to use immediately

The Market Reversal Alerts indicator identifies when a market trend is near exhaustion and ready to reverse, highlighting key market structure changes for potential pullbacks.

$99.00 Original price was: $99.00.$50.00Current price is: $50.00.

You can use product with unlimited account

Download link will be sent instantly after purchase

Pre-activated, ready to use immediately

Payment Methods:

The Market Reversal Alerts indicator is a powerful tool designed to identify when a market trend or price move is nearing exhaustion and is ready to reverse. This indicator highlights changes in market structure, which typically precede a reversal or a major pullback.

Key Features of the Indicator

When the reversal alert is triggered, follow these steps to get the most out of the indicator:

The Market Structure Reversal Alerts MT4 indicator is a powerful tool designed to help traders identify when a trend or price movement is nearing exhaustion and may be ready to reverse. It focuses on key moments in the market structure when a major pullback or reversal is likely to occur.

In this review, we will explore the features, functionalities, and how to trade with this indicator to improve your trading strategy.

Market Reversal Alerts Indicator MT4 Review

Market Reversal Alerts Indicator MT4 Reviews

Market Reversal Alerts Indicator Review

Market Reversal Alerts MT4 Review

Market Reversal Alerts Review

The download package includes the official version of the advisor:

This product is compiled by LEE SAMSON. This author has more than +4 years of experience working on MQL5 with many famous products such as Market Reversal Alerts, Stock Index Hedge EA and other products. Among them, Market Reversal Alerts is his best performing product in 4 years.

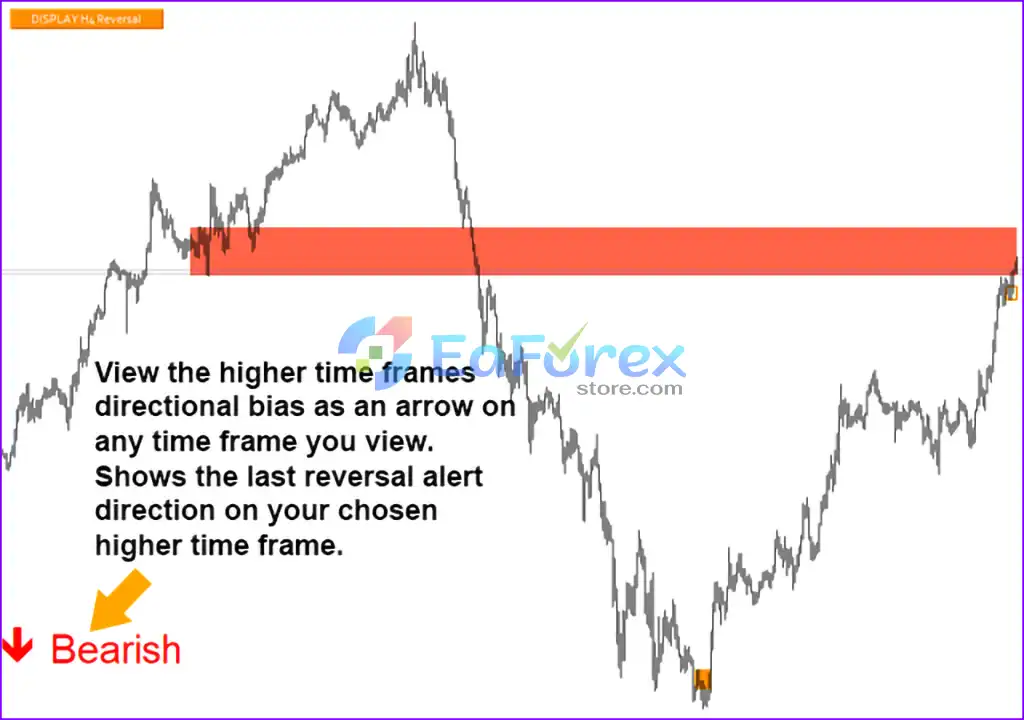

In short, The Market Structure Reversal Alert Indicator serves as an invaluable tool for traders by identifying potential trend reversals or major pullbacks before they occur. It works by detecting when price momentum approaches exhaustion, signaling a possible shift in market structure. The indicator’s ability to highlight breakouts, track price momentum, and display real-time alerts with trailing rectangles provides traders with precise entry points. By integrating key market structure insights, including supply and demand levels or support and resistance zones, it allows for more informed decisions.

This tool is adaptable to various timeframes and trading pairs, making it suitable for both short-term and long-term strategies. Additionally, the built-in pop-up, push, and email alerts enhance its usability. The optional features, such as higher timeframe directional bias arrows and trade validation, further enrich the trading experience.

>>> Reviewed by Jason Stap

1. What does the Market Structure Reversal Alert Indicator do?

The indicator identifies when a trend or price move is nearing exhaustion and may reverse, alerting you to changes in market structure, such as a reversal or a major pullback.

2. How does the indicator track price momentum?

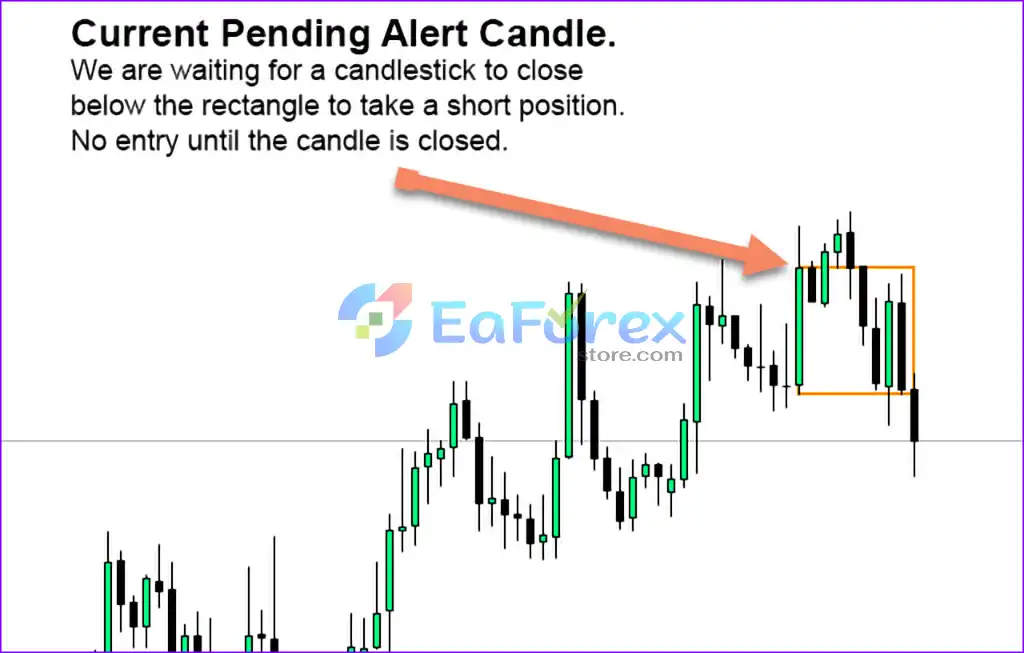

It detects breakouts and price momentum when a new high or low forms near a possible exhaustion point. The indicator then draws a rectangle around the opposite colored candle and tracks it as the price continues its current trend.

3. What is the significance of the rectangle drawn by the indicator?

The rectangle indicates the last opposite-colored candle before the potential shift in market structure. It helps you track the price movement and alerts you to possible trend reversals when price closes back above or below the rectangle.

4. Can this indicator be used on all currency pairs and timeframes?

Yes, the indicator works on all symbols and timeframes, making it versatile for different trading strategies.

5. What type of alerts does the indicator provide?

The indicator offers pop-up, push, and email alerts, notifying you of potential shifts in market structure, such as trend reversals or major pullbacks.

6. How can I confirm a reversal signal?

You can confirm a reversal by checking if there is a supply/demand or support/resistance level where price is turning. Additionally, you can consult a higher time frame for confirmation.

7. How should I place a trade when a reversal alert occurs?

Once a reversal alert occurs and is confirmed with support/resistance or other conditions, you can place a trade in the direction of the reversal.

8. What is the recommended stop loss and take profit strategy?

The stop loss should be placed just above the most recent high or below the most recent low. For take profit, a 1.5:1 or 2:1 risk-to-reward ratio is achievable, with higher rewards possible by trailing the trade along with the price as new rectangles are drawn.

9. Can I integrate this indicator with other trading strategies?

Yes, the indicator can be used alongside other indicators for further validation, or it can enhance the effectiveness of your existing strategies.

10. Are there any additional features available with the indicator?

The indicator comes with an optional dashboard add-on to monitor all pairs and timeframes, as well as a fully automated trading EA (Expert Advisor) to trade market reversals automatically.

| Trading platform |

MetaTrader 4 (MT4) |

|---|---|

| Time frames |

Any times |

| Currency pairs |

Any pairs |

| Product type |

NoDLL / Fix |

In stock

In stock

In stock

In stock

In stock

In stock

No account yet?

Create an Account

Reviews

Clear filtersThere are no reviews yet.