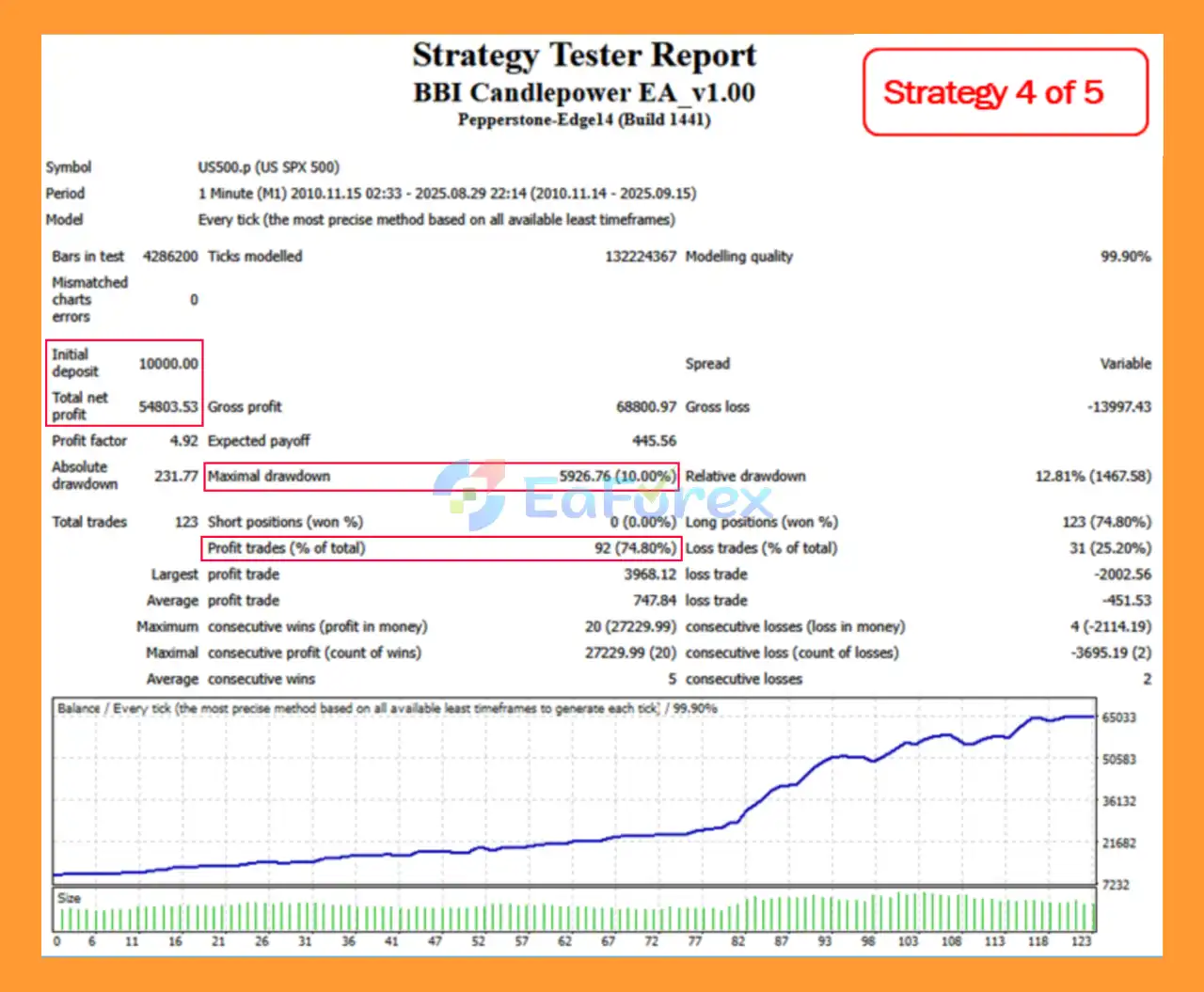

Candle Power MT4 Backtests

Candle Power EA MT4 is a mean reversion trading EA for S&P 500, using a five-strategy portfolio to trade volatility and corrections without Martingale or Grid.

$699.00 Original price was: $699.00.$245.00Current price is: $245.00.

You can use product with unlimited account

Download link will be sent instantly after purchase

Pre-activated, ready to use immediately

Payment Methods:

Candle Power EA MT4 is a professional mean reversion trading system for the S&P 500 (US500 / SPX500USD), built as a five-strategy portfolio approach. Designed specifically for volatile market phases, corrections, and stress environments, this Expert Advisor systematically trades market overextensions without Martingale or Grid. It can serve as a tactical portfolio addition or potential crash hedge within a diversified investment strategy.

>> Delivery time 24h-48h after payment.

>>> Refund if not delivered.

>>> You will receive the latest version without any limitations (ID+Time).

Candle Power EA MT4 Overview

🔺S&P 500 index – 15 consecutive years

Candle Power MT4 Backtests

>>> Join VIP Membership Now <<<

In summary, Candle Power EA MT4 is a professional mean reversion trading system for the S&P 500 (US500 / SPX500USD), built on a five-strategy portfolio architecture. Designed to exploit market overextensions during corrections, volatility spikes, and stress phases, it operates without Martingale or Grid, focusing instead on structured risk control and diversified strategy modules.

With long-term backtesting since 2010 and a portfolio-based approach, this MT4 Expert Advisor can serve as a tactical diversification tool or potential crash hedge within a broader trading or investment strategy.

>>> Reviewed by Jason Stap <<<

1. What is Candle Power EA MT4?

Candle Power EA MT4 is a professional mean reversion trading robot for MetaTrader 4, specifically designed for the S&P 500 index (US500 / SPX500USD). It uses a five-strategy portfolio architecture to trade market overextensions during volatile conditions, corrections, and stress phases.

2. What trading strategy does Candle Power EA MT4 use?

Candle Power EA MT4 applies a mean reversion strategy. It identifies overbought and oversold conditions using the Candle Power Indicator (CPI), RSI, and multiple volatility filters. The EA aims to capture price reversals during extreme market movements rather than trend continuation.

3. Does Candle Power EA MT4 use Martingale or Grid strategies?

No. Candle Power EA MT4 does not use Martingale or Grid systems. It follows structured risk management with predefined stop-loss mechanisms and diversified strategy modules to control drawdown and maintain disciplined execution.

4. What makes the five-strategy portfolio structure unique?

The EA combines five independent and uncorrelated trading modules, each operating at different frequencies and logic conditions. This portfolio-based approach reduces internal correlation and helps smooth the overall equity curve.

5. Is Candle Power EA MT4 designed for market crashes?

Yes. The system is optimized for volatile and corrective market environments, including stress phases and potential crash conditions. It can serve as a tactical portfolio addition or potential hedge component during downturns.

6. What risk management features are included?

Candle Power EA MT4 provides advanced capital protection tools, including:

8 money management models

7 Stop Loss types

6 Take Profit models

3 Break-Even mechanisms

Time-based exit functions

Volatility and trend filters

These features allow traders to customize risk exposure according to their strategy.

7. How often does Candle Power EA MT4 trade?

The EA follows a low-frequency, high-selectivity model. Each strategy module generates approximately 8–35 trades per year, depending on market conditions and logic parameters.

8. What are the historical backtest results?

According to 15 consecutive years of S&P 500 backtesting (since 2010):

Initial Deposit: $10,000

Total Net Profit: $10,423.74

Maximum Drawdown: 44.78%

These results reflect long-term performance across multiple market cycles, including volatile and corrective phases.

9. Can Candle Power EA MT4 be used as part of a diversified portfolio?

Yes. The EA is designed as a portfolio-style trading system, making it suitable as a tactical addition within a broader investment strategy. It may complement trend-following or long-term equity holdings by targeting mean reversion opportunities.

10. Who should consider using Candle Power EA MT4?

Candle Power EA MT4 is ideal for:

Traders focused on S&P 500 index trading

Investors seeking a non-Martingale, non-Grid strategy

Portfolio managers looking for tactical crash-phase exposure

Traders who prefer structured, rule-based mean reversion systems

Users wanting a diversified multi-module MT4 Expert Advisor

For those searching for a professional S&P 500 mean reversion EA with portfolio logic and institutional-style risk management, Candle Power EA MT4 offers a disciplined and systematic solution.

| Trading platform |

MetaTrader 4 (MT4) |

|---|---|

| Time frames |

Any |

| Currency pairs |

S&P500 (US500, SPX500, US500Cash), VIX, XAUUSD (Gold) and Oil (USOIL / UKOIL) |

| Recommended deposit (Min) |

$100 |

| Recommended leverage (Min) |

Any |

| Account type |

Any |

| Product type |

NoDLL / Unlimited / Unlocked |

In stock

In stock

In stock

In stock

In stock

In stock

No account yet?

Create an Account

Reviews

Clear filtersThere are no reviews yet.